केदार यांचे रंगीबेरंगी पान

Equation

Exit Policy

Bulls Make Money, Bears Make Money, Pigs get Slaughtered.

- Jim Cramer

Make a habit to have a exit policy before purchase of stock. Exit Policy makes sure that you book profit with your returns and not loss.

There is nothing called Ideal time to sell. Investment करताना एक aim ठेवायचा की मला इतके रिटर्न मिळाला की मी त्या शेअर्स ची विक्री करेल. आता हे कसे ठरवायचे. ४ factors विचारात ध्यावेत.

Moving Average Convergence/Divergence

EMA - Exponential Moving Average

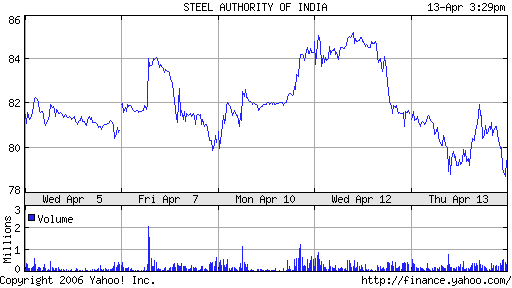

Sail - EMA Chart

MA मधे लेटेस्ट डेला ला महत्व दिले जात नाही त्यामुळे एक प्रकारचा lag generate होतो तो घालवन्या साठी EMA latest data ला जास्त महत्व देते.

EMA Formula

To calculate a 20% EMA, take todays close and multiply it by 20%, add this product to the value fo yesterdays moving average multiplied by 80%.

( Todays close x .20) + ( yesters moving avG. X .80)

This is called as percentage based EMA.

Moving Averages

Simply put a Moving average is an indicator that shows the avg. value of security's (stock) price over a period of time.

To interpret a MA, compare it to the current price of stock.

विकत घेन्याची योग्य वेळ्- जेंव्हा स्टॉक प्राईज वरच्या दिशेने MA ला छेदुन वर जाते.

सेल चा price and volume chart

volume विश्लेषण

Analysing Volume and Making Buy, Sale Decisions

Volume plays an important role in the price. Usually a when stock price breaks out to Upside, its the volume factor thats playing the role. If you pay close attention to "volume" you can make Buy decisions. But when price breaks out to downside volume may or may not be playing the role.

An increase in trading volume signifies the upside breakout from a price fromation. The larger the increase in volume, the greater is the price rise potential.

स्टॉक मार्केट - उच्चांक आणि तुटणे

Balance Sheet आर्थीक ताळेबंद

Balance Sheet is a snapshot of a business at A POINT of Time. At a particular date, usually financial year-end date, all the assets and liabilities are counted and presented as a statement. This gives the overall picture of a company. Why read balance sheet? What Do I care about that company? If you are an investor in that company then yes you HAVE to care otherwise NO.

Balance sheet is divided in 2 parts.